Welcome to our in-depth guide on chart of accounts. Whether you’re in the Bookkeeping Tips industry or just starting, this article will break down what chart of accounts is, why it matters, and how to use it effectively.

What is chart of accounts?

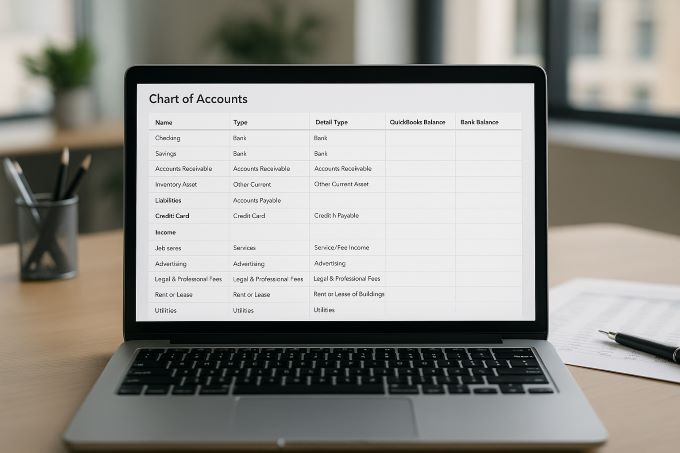

The chart of accounts is one basic step in setting up systems of accounting and bookkeeping, particularly when software such as QuickBooks is being used. It is an ordered listing of every account appearing in a company’s general ledger. These accounts are grouped into categories like assets, liabilities, equity, income, and expenses. By classifying transactions in this way, the company can monitor its financial transactions properly and consistently.

A chart can be regarded as a map for your business’s financial health. In short, it acts as the framework to organize all financial activities that are useful in generating financial reports like a balance sheet and an income statement. Usually, every account has a unique number to keep things in order, and it stands for some transactions of a particular kind.

QuickBooks offers a ready-made chart of accounts setup, which can be tweaked depending on the type and nature of your business. Cleaner charts of accounts will make for better QuickBooks organization and easier end-of-month reporting, whether you are a freelance designer or a midsized manufacturing firm.

A correctly structured chart of accounts will eliminate the need to struggle with bookkeeping errors, delay data entry, and make tax time more difficult. It remains a technical setup feature, yet it remains an important business management tool.

Why chart of accounts Matters for Bookkeeping Tips

For anyone invested in Bookkeeping Tips—whether you’re an entrepreneur, small business owner, or freelance bookkeeper—understanding chart of accounts is essential for success. Here’s why:

1. Accurate Financial Reporting

An excellently maintained chart of accounts allows for accurate financial reporting. Since every transaction has to find a place in one of the accounts listed, the structure that you choose to use will directly determine the quality of parametric financial data. Unorganized lists or methods of structuring redundant accounts induce confusion, misstatements, and worse, bad business decisions.

In the absence of a standard system, an organization might come up with multiple expense categories for the very same item- “Internet Service,” “Web Access,” and “WiFi.” This duplication fragments your financial reports and renders the task of consolidating overall spending difficult. Keeping such unnecessary duplications out is the job of a clean chart.

2. Better QuickBooks Organization

At present, QuickBooks enjoys popularity among accounting software companies, whereas its capability is dependent upon how one organizes data. The chart of accounts is the nucleus around which QuickBooks organizes itself. Meaning, a proper chart of accounts will drive us toward intuitive labels, clustering similar accounts, and hence promoting clarity and easy flow in bookkeeping.

The usual stuff that QB offers to organize things really is: accounts, classes, and locations. Classes and locations apply if the chart of accounts is simple, straightforward, and properly laid out. Users then develop reports and dashboards that reflect actual business relations, knowing these mappings.

3. Facilitates Compliance and Tax Preparation

Tax time represents invariably a stressful period. However, if the chart of accounts in view of IRS classifications and industry standards is maintained in an orderly manner, filing becomes abundantly easy. With appropriate account titles, businesses can compile deductible expenses faster and determine tax liabilities to complete Schedule C, Form 1120, and other forms more efficiently and accurately.

Tax time represents invariably a stressful period. However, if the chart of accounts in view of IRS classifications and industry standards is maintained in an orderly manner, filing becomes abundantly easy. With appropriate account titles, businesses can compile deductible expenses faster and determine tax liabilities to complete Schedule C, Form 1120, and other forms more efficiently and accurately.

4. Scalability and Long-Term Planning

If a bookkeeping system works well, it equips the business for today and for future growth. As the business increases its offerings, workforce, and probably locations, the financial tracking also needs to upgrade. A good chart of accounts gives scope for scaling up without any matter of disorganization or loss of clarity.

To ensure a QuickBooks organization remains scalable, a certain amount of room is left within the account numbering system to grow. For instance, if you have a 4-digit system, you could follow from 4000 (Sales Income) with 4010 (Online Sales), 4020 (Retail Sales), and so forth. This foresight saves you from disruptive revisions later on.

5. Enhances Internal Controls

By setting up accounts within a secured QuickBooks system, businesses may enforce controls internally. Such controls assist in preventing fraudulent activities, double entries, or misclassified transactions- all of which may distort financial reports or mislead management decisions.

There is enhanced transparency and accountability when the various payroll expenses are broken down into taxes, wages, and benefits. Likewise, custom user roles may be created within QuickBooks and aligned with chart of accounts access to safeguard integrity and protection of data.

Understanding how the chart of accounts affects QuickBooks’ performance as an organization can be a make-or-break aspect of his business success. One of the world’s largest companies, among other examples, is this case.

Best Practices for Customizing Your chart of accounts

Starting with and customizing your chart of accounts is an important step for a startup, small firm, or an evolving entity. Having a fine-tuned COA basically means you collect data pertinent to the industry you operate in and no excess/inappropriate information, thus cleaner reports, and better qualified financial decisions. Here are some important pointers that will help you in molding your chart of accounts to fit your QuickBooks organization better:

- Keep it streamlined: Avoid cluttering your COA with unnecessary accounts. Every account should serve a defined purpose tied to your business operations.

- Use standardized naming conventions: Clear and consistent naming makes it easier for bookkeepers, accountants, and business owners to navigate the chart quickly.

- Segment by core function: Group your accounts into key functional areas such as operating expenses, revenue streams, assets, liabilities, and equity.

- Review and revise regularly: As your business evolves, so should your COA. Schedule regular reviews to ensure your ledger reflects your latest structure and priorities.

How QuickBooks Organization Integrates with chart of accounts

Being partnered with a dependable chart of accounts, this can exponentially increase bookkeeping efficiency. QuickBooks comes with templates for several business types, from services to retail to nonprofits. This package accompanies a predefined COA that users customize according to their unique requirements.

Here’s how QuickBooks organization benefits from a robust COA setup:

- Automated categorization: The transactions are automatically classified by QuickBooks on the basis of the Chart of Account. In the presence of a well-structured COA, lesser chances for data mismatch automatically means faster processing for data reporting.

- Custom reporting: Generating financial reports becomes straightforward when accounts are defined. The aid for budget planning, forecasting, or cost control sensibly becomes efficient for all.

- Data syncing: For ease of data flow and stable balance, correctness in COA mapping is the key to integrating with crucial systems including payroll, inventory, and bank services.

In order to ensure sustainable growth and minimize the possibility of making the same mistakes in the future, the company needs to take a good look at itself and install an internal control platform over those assets.

Managing Growth with a Scalable chart of accounts

As the business grows, smooth finances need to be maintained with increasing complexity. So should the chart of accounts, wherein it should be able to scale for clarity and control purposes. From creating departments to launching products and entering markets, any changes should be absorbed by the COA without disrupting anything.

Here’s how to keep your COA scalable:

- Use account numbering systems: It may be helpful to sort and group accounts logically, making it possible to insert new accounts without disrupting the entire structure.

- Future-proof categories: Consider growth areas when designing account types and categories. Keep the numbering and naming conventions flexible for further additions.

- Create sub-accounts: Sub-accounts exist so that detailed transactions with a parent category can be tracked, which means all necessary details can be retained while high-level reporting continues to be kept nice and neat.

Common Mistakes When Setting Up a chart of accounts

A business could mean well in setting up a chart of accounts, but even in this capacity some of the most trivial mistakes can really knock some sense out of its books. Avoiding these common errors is very important when it comes to plain accounting:

- Overcomplication: Making too many accounts may turn financial reporting into tricky business and give a confused approach.

- Lack of standardization: Inconsistent names and account codes might result in rehandles or inappropriate classification of data.

- Failure to review: Ignoring periodic COA reviews can sometimes result in old accounts that do not truly reflect actual business transactions.

- Mixing personal and business transactions: Always consider when you check personal financial statements alongside the business account. Mixing both can compromise, compromise, or paralyze accuracy and tax compliance.

Examples from the Field

Consider the situation of a medium-sized eCommerce firm with QuickBooks installed. At first, their COA contained close to 200 separate revenue accounts for every product category. Overscaling made management tedious and prone to error. By restructuring their COA with fewer parent accounts and well-labeled sub-accounts, they improved the accuracy of reporting and reduced the time needed to close the books at the end of the month.

In another instance, a service business consolidated duplicate expense accounts and standardized the naming conventions. Consequently, the monthly QuickBooks reports became slightly easier to analyze, leading to better decision-making in regard to the sinking of resources and marketing efforts.

Conclusion

For any well-performed bookkeeping entry, a well-structured chart of accounts must be considered. Whether you are starting to set up your QuickBooks organization or refining a present one, your COA structure is an investment on financial visibility, compliance, and strategic planning. Part 3 will give you more advanced solutions for optimization and automation for COA success.

Making the Most of Your Chart of Accounts

While basic bookkeeping provides a mere start, creating a robust chart of accounts (COA) allows for accurate financial reporting and better business decisions. Setting up a COA in the right manner through QuickBooks or any other accounting software would be instrumental in keeping the business finances clear and in control.

Put in the correct way, the chart of accounts takes each enterprise’s income, expenses, assets, liabilities, and equity into some logical arrangement. Hence tracking financial performance becomes easy, as would categorizing transactions and to ensure that nothing is ever missed in it. Organization can literally mean a world of difference come time for taxes, not forgetting the day-to-day dealings, particularly for small businesses and entrepreneurs.

Tips to Optimize Your QuickBooks Organization Using the Chart of Accounts

- Limit Redundancies: Avoid duplication on accounts. Every account should have a definitive purpose and must never clash with another. This builds from ambiguity and mushes down categorization.

- Use Account Numbers: Assigning account numbers in QuickBooks facilitates sorting accounts or locating them from a list. For example, one can use 1000s for assets, 2000s for liabilities, and 4000s for income, so forth.

- Group Similar Items: Create parent categories and place related accounts underneath them so that piechart reporting is facilitated, for instance, the Utilities account could have Electric, Water, and Internet as sub-accounts.

- Tailor to Your Industry: The varying needs of different businesses make it impossible for our sample Chart of Accounts to be detailed enough for its clientele. For instance, a construction firm will want to have accounts for project costs whereas a retail enterprise would want accounts to track various types of inventory and cost of goods sold (COGS).

- Perform Regular Reviews: As the business prospers, the financial structure undergoes changes. Audit the company’s chart of accounts quarterly, removing obsolete categories and ensuring it remains aligned with business objectives.

Common Mistakes and How to Avoid Them

- Overcomplicating the COA: Concerning excess, sub-accounts rack confusion with the so-called helpful method. Keep it simple — have only as many accounts as you actually need.

- Generic Naming: Avoid naming categories as Miscellaneous or Other Income. Be as specific as possible as to what each category includes.

- Not Using Classes or Tags: With QuickBooks, you can use the class tracking approach or tags along with the chart of accounts for getting a deeper insight into department-level or location-specific spending.

Chart of Accounts for Future Growth and Scaling

The CoA must grow and evolve along with your organization. Hence, build your COA in a way that it will scale. In case you plan to add more services or hire more people or open a location, then creating a CoA that is made for the future will surely save your valuable hours later.

Since this transition involves freelancers going from a single-person business to a full agency, the chart of accounts must change from categorizing simply income or expenses to being more specific about payroll, employee benefits, separate client projects, marketing expense, and other such things.

To prepare for scaling:

- Set up placeholder accounts for categories you expect to use in the near future.

- Use consistent naming conventions for easy account identification.

- Leverage QuickBooks tools to customize reports based on your evolving COA.

Frequently Asked Questions

Next Steps

Need help organizing? Contact us

Ready to Build a Powerful Chart of Accounts?

Such an endeavor to create and maintain a streamlined chart of accounts could, in theory, feel more than overwhelming; do not think yourself alone in this. A properly customized COA will be able to give an extra kick to the organization in QuickBooks, but for that, one must have a good working knowledge of strategy and expertise.

Consider working with professionals who understand your industry and goals. At Maikai Bookkeeping Services, we specialize in custom bookkeeping setups, including full chart of accounts optimization for growing businesses.

Start now:

- Explore our Small Business Bookkeeping Services

- QuickBooks Setup & Organization Help

- Learn More About COA on Investopedia

- Forbes: Why Clean Financials Matter

Need help organizing? Contact us today and let’s build your financial clarity together.