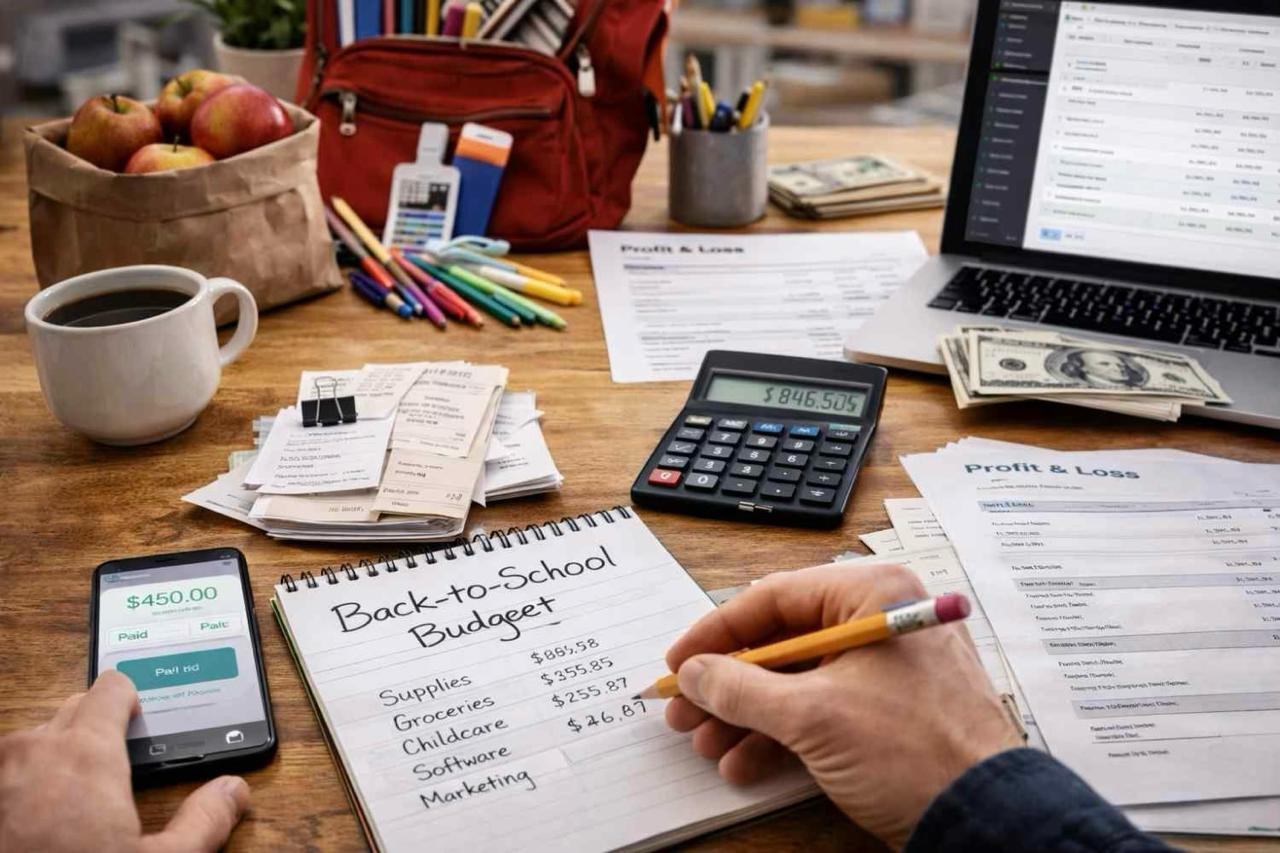

Unveiling the best practices for budgeting, the “Solo Back-to-School” Budget Tips for Solo Entrepreneurs touches on every tip entrepreneurs must know-especially when it comes to proper budgeting tips, examples, and strategies to get better results.

What is budgeting tips?

Advice on how to create a budget really comes down to the implementation of strategies that have been proven and can be highly effective management tools for personal finances, especially when dealing with solo entrepreneurs. Turning the calendar to August 2025 now, and openly, people are planning how they will do shopping for their personal affairs and business in anticipation of a new school year. It is nostalgic because there are new schedules, expenses, and unforeseen financial fluctuations that can be felt only by handling money properly. With some budget tips below, you can quickly switch gears and still keep your eyes on the objectives at the end of the day.

Because cost-cutting is not the only thing with budgeting tips; it covers the coming and going over seasons, the mindful spending, and cash flow forecasting, but also goes into buying things or services that actually help one to become more productive. In the case of solo entrepreneurship, it often results in juggling with the monthly marketing or software-subscription bills on the one hand and the children’s school supplies and necessary home modifications on the other.

All alludes from these points that should also address affirming rather positive spending habits, specifically through change of seasons-like at the end of summer. This gates setting up for Q4 sales, gathering money for tax prep, or just promenading in family when the temperatures start to dip in autumn; budgeting tips provide much-needed order amid financial chaos, ensuring that you make more intelligent choices even throughout the year with money.

Why budgeting tips Matters for Financial Checklists

The effectiveness of a financial checklist depends entirely on perfect planning. Budgeting tips come in here. Behind every checklist, there has to be strategic planning, and seasonal checklist goes hand-in-hand with a budgeting tip. However, the single one may be very exhausted with various tasks because the whole things are being managed together, either documents or content; however, the financial side of the operation ought also to change with every season.

The month of August would be one of the major reference points. It’s generally the last month for businesspeople before they ramp up for the final quarter of the fiscal year. While students finish their holidays and families set back to routine, they will spend a bit more. Giving August the badge of a transition month is not just about changes in lifestyle; it surely is a financial reorientation. Hence, the solo entrepreneurs who miss it usually undergo the situation where they’d get a crunch in finance in the last few days of September and especially October.

Time-and-budgeted financial checklist alignment can reasonably facilitate making a proactive strategy. It means you might be going for the start-up of a new product through the upcoming autumn. I think budgeting now in August could help to squirrel away amounts for ad promotions, email marketing tools, or maybe even design services preemptively, ruling out last-minute overspending, or having to dip into emergency savings.

What does this have to do with actual performance attributions for these types of recommendations?

- Scenario 1: A freelance developer identifies that their clients slow down in August, so they use this as a chance to review software subscriptions and pause underused tools to save $200/month.

- Scenario 2: A solo digital artist has children returning to school in mid-August. She adjusts her work hours to free mornings and spends time planning October promotions now to avoid burnout later.

- Scenario 3: An online course creator sets up an automatic funnel budget with limited ad spend caps in August, conserving cash flow while staying consistent with outreach.

As these scenarios show, budgeting is about more than dollars; it’s about deliberate flexibility. It’s the financial version of designing your workflow to meet real-life events. Seasonal financial planning through budgeting tips ensures long-term sustainability instead of short bursts of success that ultimately lead to burnout.

Budgeting also supports your mental clarity — a huge asset for solo entrepreneurs. Knowing you have a financial action plan aligned with the back-to-school season minimizes overwhelm. A well-thought-out financial checklist built upon sound budgeting principles becomes your go-to roadmap that can be modified as life changes, but never leaves you entirely unprepared.

In the months leading up to year-end, especially starting in August, embracing strategic budgeting is more than advisable — it’s essential. From adjusting recurring expenses to consciously scaling client work, each choice you make now relieves pressure later. The first step? Reviewing your current budget and realigning it with both business goals and personal obligations that the new school season brings.

Understanding how budgeting tips influences your seasonal financial planning performance can make or break your success. We’ll explore real-world examples next.

Best practices for ongoing budgeting success

Consistent application of the budgeting tips will form a habit leading to long-standing financial clarity, but their assimilation into a day-to-day habit results in long-term success. Below are some suggestions for you that can bolster the seasonal financial planning and make your financial checklist be fully effective throughout the year.

- Put numbers to it: Create measurable goals: Whether it’s saving for holidays or preparing for tax season, clear and concise financial objectives that are specific to various seasons always keep you focused on budgeting.

- Heat the spending trends Monthly: Analyze spending from month to month to notice any fluctuations and make adjustments. This is a critical part especially during the high-spend months like December or back-to-school season.

- Include cushion categories: Emergencies do not need to impede progress. They can be a drawback during erratic seasons such as winter storms, unsettled summers, or summer vacations. Budgeting for emergencies will keep you on course despite any surprises.

- Automate whenever possible: Automated savings transfers or bill payment tools may help you stay consistent even through busy times.

- Quarterly: “Review and then update to align a budgeting strategy to the changes with the passing of time through the year” says Warren, presenter and financial adviser.

Integrating budgeting tips with seasonal financial planning

The integration of budgeting tips and seasonal financial planning results in maximum financial flexibility. Each season comes with its peculiar expenses and opportunities; therefore, it is essential to adapt your planning strategies accordingly–only because that financial agility is the core benefit achieved. Here are some results to synchronize the two points for best results:

Spring Planning:

Putting budgeting tips into action during this time can best handle tax return season, spring travel, and new project initiation. Some items on a checklist will include organizing documents for tax and tracking refunds, while preparing for the potential costs to home improvement.

Summer Adjustments:

The summer is a stage when the family looks forward to vacations and summer child care, as well as rising utility bills take their toll. Employ your budgeting techniques to set up sinking funds and adjust your, perhaps discretionary, spending categories accordingly.

Fall Preparations:

Study the budget again. Themes of this time week may involve the fall “back to school,” adjustments should include budget items for extracurricular activities, such as these expenses related to the re-entry of holidays.

Winter Readjustments:

For winter, there are now higher heating costs and holiday spending as well as the end-of-year financial review itself. Tips in budgeting aimed at year-end checklists and bonus allocation strategies can close another year with strikingly strong financial footing.

Tools and resources for applying budgeting tips

Implementing budgeting tips consistently is easier if the right tools and platforms are at your disposal. With the right digital tools and platforms, a person can actually do better financial planning within seasons-from tracking expenses to automating savings.

- Mint: Mint is a great budgeting tool for beginners—in a true sense of a utility that guides and catalogs your spending as time breaks and starts to trend, and Mint is excellent at incorporating financial checklists for every season.

- YNAB (You Need A Budget): This app is appropriate zero-based budgeting; in my opinion, it is my favorite for getting the personal touch of accounting to seasonal changes in budget.

- Excel or Google Sheets: If you appreciate total control, you could create a custom spreadsheet, thereby following the manual tips about seasonal budgeting by integrating the intended strategies with the spreadsheet after omitting them to the seasonal goals.

- Calendar: based budgeting templates: You can schedule the financial checklist reviews quarterly through the use of digital calendars. Planning of the financial plan revision will enable a rookie to keep in view their financial status assessment with financial targets-audit-annual audit and seasonal audit should be conducted accordingly.

- Auto-pay and savings systems: Automating payments and transfers ensures that essential elements of your budget are executed even if some kind of unexpected changes arise.

Common pitfalls and how to avoid them

Putting your financial checklist through some refinements will make all the difference between the best advice and wasted time.

- Seasonal patterns are ignored and do not give attention: For example, the holiday’s cost or summer’s journey change the prospects and meaning of the budget very quickly.

- Setting targets that seem unachievable: Better to set lofty achievement goals rather than forget about fixed and seasonal extra compulsory spending- this may end in frustration.

- Lack of periodic reviews: A budget that had been set in place was ineffective. Monitor and regularly adjust for actual usage and seasonal shifts.

- Placing manual method as tracker: This account for personal tracking can burn out, as they become more complicating. To the maximum extent possible, they should want to be simple with the help of technology.

Measuring the impact of budgeting tips

To ascertain that the tips on budgeting exert value, metrics must be established for reflection of short-term victories and the availability to sustain in the long run. There are cardinal ways regarding performance measurement.

- Savings growth-Profit: Quarterly comparison of savings balances is one way by which moving ahead may be said to be substantial, particularly after seasons of high expenditure.

- Debt reduction: Scope for determination and evaluation of the success of one’s budget: a fall in credit card and student loan balances.

- Reduce financial strain: Emotional well-being is undoubtedly credible-if your budget simplifies things in life, then it is effective.

- Rate of Completion Checklist: Ensure a constant rise in the percentage of completion scores in the periodical financial planning for all points in the seasons.

Seasonal financial planning and budgeting tips allow you always to be ready, flexible, and confident in any time of year. Regularly adding up these solid financial checklists, with just the right amount of application, makes you capable to face the present needs besides paving ways for future objectives.

Bringing It All Together: Creating a Year-Round Financial Strategy

In the case of seasonal changes, financial needs need to be changed. You have to deal with back-to-school expenses in the fall, festive season spending during winter, springtime management for weddings or tax season, and getting ready for vacation expenses during summer. Four-sided budgeting might as well keep you centered. Effectively formulate customized typical systems of financial planning for each of the seasonal changes. You will stand better positioned to forecast expenditures, enjoy savings opportunities, and be prepared for those unexpected expenses.

Considering the financial year alignment and the way budgets are built around specific key seasonal tendencies, the focus moves to a more lasting effect. When you have an established framework that considers various cash flow variations and goals for measurement, your budget is not just documentation but a powerful tool for financial management. This way you will complete the budget phase until-after that year, you’re done (or drop the paperwork off as a thief leaves the scene). For example, apportioning money for an annual maintenance task (like servicing of the HVAC in spring) or saving for some high cost peak-period can prevent the accumulation of debt and hence less worry or stress.

Savvy consumers will also have ‘budget margins’ incorporated within each season. These budget margins—savings in ‘cap’—will cushion anyone’s fall in budget dislocation in case of an emergency, no matter how small it might be. It may come along with sacrifices such as cutting on the luxuries of taking care of your monthly meals, or saving an additional $50 every month during more expensive periods.

The stakes are very much higher among entrepreneurs. Modeling the dynamic cash flow forecasting of having some seasonal variation of business sales has been made essential. Identification of low sale periods and review of high-cost times also help entrepreneurs maintain constant operations and pay themselves consistently on a regular basis. Plus, quarterly after-ends ensure the trimming of their business before the financial stone rolls down the finances hill.

Smart Budgeting Habits for the Long Haul

The core of successful budgeting lies in an adaptable, long-tenured finance habit. Here’s a snapshot of habits that can deliver tangibly.

- Automate Savings: Execute scheduled transfers based on income cycles and the few peaks of the annual, seasonal, high-cost items.

- Monthly Review: Monitor progress and tweak expenses in a budget meeting with yourself, or bookkeeper, every month.

- Track Unexpected Costs: Put a “surprise expense log” aside to forecast more accurately each year.

- Celebrate Completion: Upon achieving financial targets, celebrate responsibly! This promotes reinforcement positively throughout the year and keeps the momentum high.

Preparedness and not perfection is the prime factor in financial readiness: with mindful spending, strategic forecasting, and regular check-ins in place, a flexible and sustainable approach takes life in your budget plans. When usefulness periods and your expenses’ rhythms are mastered, restoration of control of the year is done month by month, season by season, and year by year.

Frequently Asked Questions

What is budgeting tips in simple terms?

Budgeting tips is a strategy or concept used to improve seasonal financial planning by focusing on structured, intentional methods.

How does budgeting tips help?

It helps improve performance by aligning your content with search behavior and industry best practices.

Can I apply budgeting tips myself?

Absolutely. With the right tools and structure, even beginners can begin applying these principles effectively.

What tools should I use?

Start with Google Search Console, SEMrush, and keyword research tools. These provide visibility into how budgeting tips impacts performance.

Next Steps

On the bandwagon for a complete financial-the view of season? Rake for this is worth its way in gold; do not be caught napping when the next money crunch comes and snag the newest Check Your Budget list today to begin constructing a flexible but potent strategy that molds itself to what happens during the year.