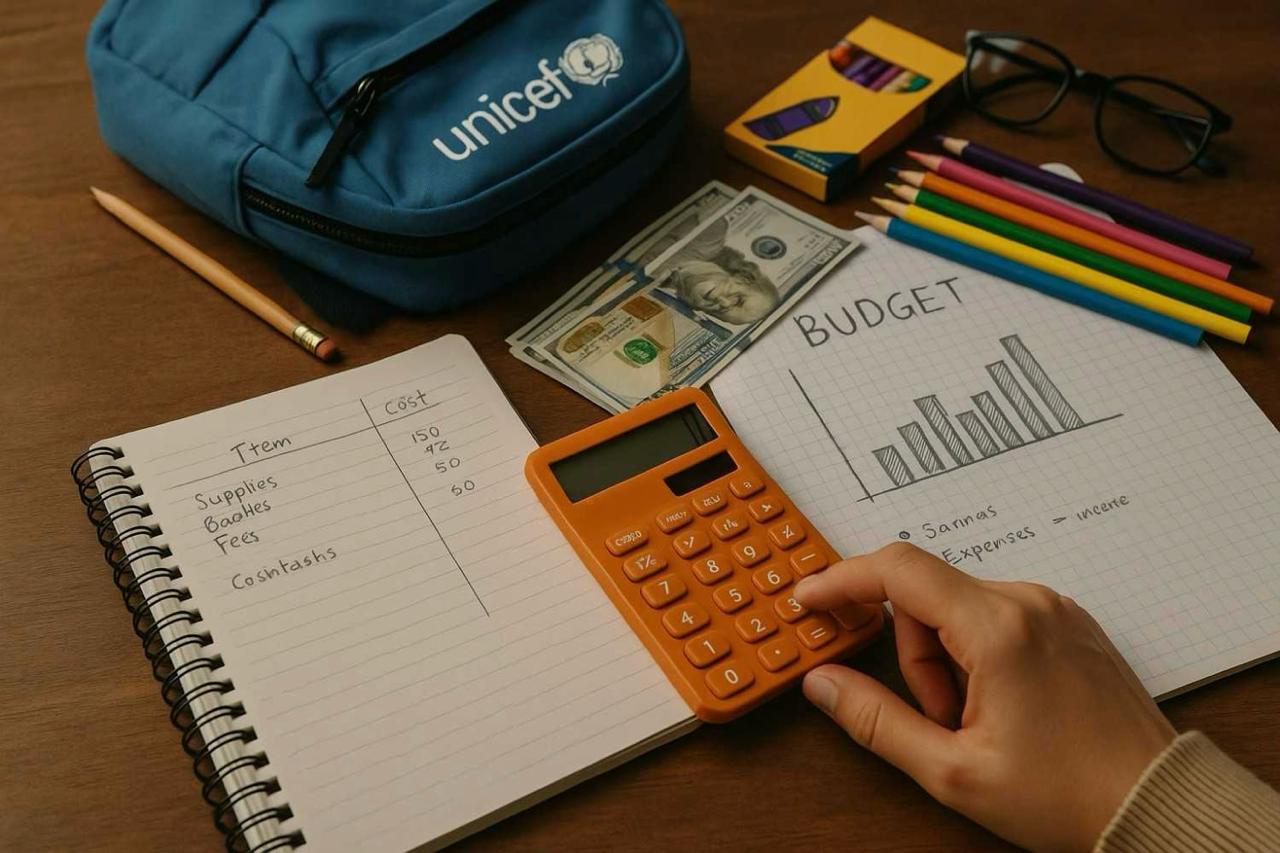

This presentation of Budget Tips for Back-to-School Solo Entrepreneurs has everything you need to know. Find helpful tips, examples, and strategies to ace the output.

Welcome to an in-depth guide to budgeting tips. Whether you are from the Financial Checklists industry or just starting, this article will help you understand what budgeting tips is, why it matters, and how to use it.

What is budgeting tips?

Budgeting tips refer to know-how, guidelines, and insights that allow individuals, particularly the solo entrepreneurs, create plans, track expenses, and control expenses to optimize the results. These play a crucial role in positive financial planning and safeguard that you can maintain financial stability right through the stages of fluctuating business. Particularly during expensive and significant transitional periods such as back-to-school season.

August 2025 is the time for even children to have a good time, because that means summertime school or something that is about to end for a few months. That is also the time for business families to consider a series of strategies for managing inflows and outflows and maintaining other short financial goals related to child education or maybe less time but yielding business from entrepreneurship. In this, the challenge tips empower you in the changes that will happen with strong efficiency and accuracy.

Business owners who are on their own do not have the budgeting going on in their own accounts; rather, they label maximized budgeting programs for costs and incomes of businesses on the whole. They should also put lower priorities on activities that unnecessarily consume money and strive to have meshed personal and business goals with respect to finance. Essentially, balancing involves setting when to invest, when to save, and how to leap on opportunities.

Core Elements of Budgeting Tips

- Expense tracking: right from an honest overseer of almost all money that flows your way to a plethora of findings with respect to the tools to mark on list which are no else but QuickBooks self-employed, Mint, YNAB (You Need A Budget), with items of categorization.

- Forecasting income: Your income will vary from month to month. Holistic budgeting dictates that conservative estimates ranked over cash buffers created during peak income months. Make sure you keep a rainy day fund.

- Financial goals should be structured smartly by SMART: Here, yet these short term and long term objectives would be objectives that are feasible, measurable, and realistic. There may be goals to be achieved like investment on office equipment during Q3 or a commitment to save for a Christmas marketing.

- Those are savings buckets: you would have different savings accounts put together for business taxes, emergencies, and personal goals so that you won’t blow all the operational flow when the unexpected costs arise.

- Habit of responsibility: terminally overwritten to the nth degree is the simple consequence of weekly check-ins, monthly reviews, and altering one’s personal routines, which collectively keep the budget flowing with evolving circumstances.

Budgeting effectively gives insight into actual financial reality and provides tools to alter it. This proves its importance especially during transitioning periods like August when business demands change along with proper work-life balance—back-to-school keeps going at its accelerating pace and also increased utility costs, as well as revival of service subscriptions.

Why budgeting tips Matters for Financial Checklists

A financial checklist planned for the season-oriented solo entrepreneur is something that ensures staying well organized, well-informed, and proactive. Good budgeting tips in the financial checklists during this season can be great as the back-to-school season can come to be a juggling act within so many finance conflicts. What are you juggling work-wise, personal-wise, school-wise, and what have you? New school supplies, after-school care, extracurricular costs—all this during a Q4 preparation for marketing stretching reality.

Financial checklists on how best to utilize one’s time during these times grant to-dos that you can’t miss. These financial checklists are best driven by the tips on saving or limiting spending, for they turn such vague to-do items as “update budget” into actionable, specific strategies.

Tips on saving or limiting spending amplify how much use you cash in by designing financial checklists in August 2025:

- Resource Awareness: Across more significant industries, the income lull during late summer is followed by the pre-holidays surge. Budgeting tips including matching fixed costs with conservative income projection help curb any cash gaps.

- Stocks and Stuff: For businesses that revolve around product, inventory practices are designed on something one is planning so that historical sales trends don’t just look back into past inventory investment or lead to overstocking as well as overlooked opportunities.

- Family-Based Adjustments: For parents I can input the time from now to reconsider a childcare budget, lunch expense and back-to-school technology needs. Yes, the business budget can flex exponentially with changes.

- Q4 Offers Finance-Based Prep: Planning financial gains for October November through spending maximum amount productively in August for spending during marketing September and October before starting holidays.

- Profession Development: Every solo business person must remain very competitive. One can set aside funds in August for seminars coming in September software renewals, or training before the prices change at year-end mainstreaming.

Such applied financial tips show that from emergency actions to proactive planning, financial arrangements shift. Keep your budgeting lists to accommodate those rolling-up reviews. Things like aligning your August expenses with potential tax obligations or renewal of annual licenses in your calendar.

Consider this real-life story concerning Joan, a virtual assistant and single mother. She’s usually busy during the August month-from July to September-as she also has to prepare and organize her “A Back to School Budget Challenge.” As she adjusted all her client contracts, rearranged pricing on her new and updating packages for her retainer with clients, she even stopped paying for two of her software subscriptions that she was not using to save for school needs. It was most likely going to help her fund her own quarterly tax payments. Due to those 30 minutes spent in natural budgeting every day, August was another month spent as an advance of her financial goals rather than lag.

Budget-related advice is vital because of how transformative it might be for your decision-making process. Guessing will be replaced with solid knowledge, the result of learning budgeting tactics. If you throw these into your list of financial management on a daily basis, you will surface opportunities you could miss altogether, as well as blind spots.

Frequently overlooked in its capacity to provide new strategies and procedures, budgeting advice should ideally serve as guides and helpers during this critical season, escalating limitations. You can prepare your financial checklists sometime in July so that, by September, you are not doing catch-ups, but you are doing smart play.

Budgeting tips are your best friend during this critical season in which you scramble through receipts, confusedly wonder about tax set-asides, or be surprised with forgotten automatic bill payments. You may want to set up your financial checklists now, that by September, you are not catching up, but you are smart playing.

Our expertly designed budget tools are great for solo entrepreneurs in August 2025, so you don’t have to do this alone. Are you ready to simplify this aspect of your planning?

Grab your budget checklist today and start taking control before back-to-school spending controls you.

Integrating budgeting tips with seasonal financial planning

One of the most strategic ways to maximize the financial checklists values to align budgeting tips with seasonal financial planning. Different times of the year require different financial approaches. For instance, the end of the year might include tax planning, while mid-year might require an adjustment to actual spending as compared to planned budgets. When it comes to changes in seasons, businesses and individuals may apply budgeting strategies that complement each other, not only enhancing agility but also helping to avoid financial strain” activities or events like back-to-school shopping or holiday gifting can generate benchmarked expense seasons for planning by setting aside a certain amount of your monthly income a few months prior.

For a business, integration of seasonal benchmarks, for example quarterly sales cycles or fiscal reporting periods, would help in ensuring consistency in cash flow. For families, that planning could be in the form of providing for expensive seasons like the back-to-school season or gifting at the holidays by setting aside a contribution from monthly income in advance. Creating a checklist that reflects these changes helps evolve budgeting tips with related shifts in the prioritization through the year.

Common mistakes to avoid in budgeting tips

- Missing out on periodic costs: Avoiding seasonal costs like Christmas vacations, or annual subscriptions; it may throw a wrench in your fine budget.

- Making it over-complicated: It should use modern and complicated financial models that could create a lot of unnecessary anxiety and confusion. On the contrary, keep it simpler by using user-friendly budgeting apps as well as simple and basic spreadsheet templates.

- Skipping scheduled reviews: On the flip side, financial checklists are supposed to be dynamic so that in case you happen to forget reviewing at certain months or quarters, these glaring inconsistencies will be automatically evident.

- One-Size-fits-all Planning: Eventually, one-size-fits-all planning will be to the disadvantage of a company’s bottom line. You must make use of standardized templates that may not be personalized according to a company’s specific goals and seasonal needs.

Customizing budgeting tips for different lifestyles

Each budgeting is personal. In reality, effective budgeting is not one-size-fits-all but should be tailored to different lifestyles, incomes, and goals. For example, those with irregular incomes (like freelancers or consultants) might want to choose between scheduled budget allocation in a zero-sum fashion or use the common envelope system for optimal deployment of every cent. From the other side, salaried employees can have specific savings targets through a percentage of their incomes, seeing that bills are automatically paid.

For households with children, school fees, extracurricular costs, and so on would point to the necessity of prioritizing the tips of certain budgets for emergencies and a long-term school-leaving provision. Aging or aging’ families with a fixed income may focus on reducing fraud while still having access to health care and necessities. Financial checklists for specific stages or transitions from one life stage to another can encourage much more efficient planning.

Using digital tools for budgeting success

By the use of financial technology, applying one budget tip after another is becoming significantly easier. With the use of electronic devices and wallets like Mint, YNAB (You Need A Budget), and PocketGuard, people now find it easier to synchronize and track their financials, as well as get different output on categorized expenses in real time. A lot of these also apply now special seasonal components for financial planning such as goal setup for your online trip or to set aside funds for buying gifts during holidays.

Furthermore, spreadsheets like Microsoft Excel or Google Sheets are now seen to be quite useful when shared within families and groups. They enable collaborative effort and possess features like conditional formatting, charting of conditional formatting, and even graphical visualizations of spending trends. If you are into individual work, you would even benefit by using such a tool, as money list multiplication always becomes much more manageable.

How budgeting tips improve long-term financial success

Even more than this, organizing budgets helps not only in covering immediate expenses, but it also underpins progress in life and in the long run. A well-structured budget, combined with an ongoing review process, incorporated with seasonal financial planning, leads to goal setting: it empowers one to make more informed decisions for investment that prepare them for retirement. Increasing the level of financial literacy is another impact: all too often, money matters come with stress.

Particularly, in the event of the interplay of budgeting models, enterprises could establish resilience and less vulnerable to economic downturns, thus allowing for strategic scaling and enhancing their creditworthiness. On the other hand, individuals who follow time-tested budgeting principles are less likely to service debts, save consistently to capitalize on compound interest, and make major life accomplishments as significant as buying a house or planning for further studies.

Final steps in your financial checklist strategy

Film-lovers will spend most of their time immersed in the world of movies, but they need to spend some time on other things—a financial checklist being one of them. They will consider how the checklist can reconcile their broader goals with their ideas of budgeting. Their evaluation will address their short-term needs and their long-term plans like paying it off with a credit card and saving money for their child’s college fund. According to the new season, budget as well as checklist adjustments need to be made. They will likely seek the advice of professionals in the field or reuse data from the past to improve the model for the future.

“It’s really not about a control system of no or restriction. It’s allowing you to have a greater level of peace of mind and confidence when you rely on timely data, seasonality insights, and seamless strategies. Financial transactions are streamlined as decisions are more systematic and regular.”

Maximizing the Benefits of Budgeting Tips

It is quite clear at this point that practical budgeting tips do significantly boost seasonal financial planning. What is it actually like to execute this?

Summer comes along, and with it vacations, weddings, and an extra few costs. Employ budgeting correctly such as through envelope budgeting or by using zero-based budgeting systems, looking and biting such expenses in the bud and redistributing your income wisely. It changes to proactivity instead of reactivity in your financial planning.

At the fall and the concentration of the school season expenses plus the year-in-review stress stage, these same points will help you. For categories such as school supplies, home heating, and holiday gifts, you should implement a spending cap that would be based on historical data, minimizing the credit use and last-minute borrowing.

It can become quite a challenge during the winter months with heating and electric bills going up unexpectedly or annual property taxes hanging heavy upon a homeowner. The asset cushion is a way of establishing future contingencies, which one can keep separate in a savings account, and then be able to think about using money in the meantime to make out payments or meet unexpected costs, without falling behind on the predetermined financial plans.

Long-Term Financial Planning Through Budgeting

Budgeting goes beyond just saving for the short term. They pave their ways for larger long-term objectives to achieve. Be it retirement planning, investing in real estate, or kick-starting a new venture, organized financial planning will never let you fall behind without a roadmap to guide your decisions.

Visualizing the year round-or rather mapping out your year with checkpoint markers-creates the foresight of a seasonal nature. For sure, when you have earmarked funds for quarterly investments, the renewal of your annual insurance, and the pending tax preparation deadlines, Seasonal Financial Planning really starts to reveal its depth.

Moreover, attaching your budgeting agenda with tools such as YNAB (You Need A Budget), Mint, or QuickBooks becomes smart. It will then introduce more clarity and automation to the budgeting process. Much is simplified thanks to these, the income flow can be tracked, trends can be analyzed and adjusted real-time, not at the end of the year, which frequently is too late.

The Human Element: Behavior and Mindset

Emotions and habits are tied up on financial decisions as it is not just to be all about numbers. This is one other reason why the mind-change that comes along with the numbers is very important in every budgeting tip.

For the most past, this would involve the sort of routine behavior like making weekly budget reviews, setting SMART financial goals (Specified, Measurable, Achievable, Relevant, and Time-bound), or at times monetary type rewards. This way, budgeting becomes something to respect instead of something to loathe.

Sharing budgets or family discussions where accountability is in this creation bring about the best results. When your group of supporters and helpers is aware of what comes first in your financial priorities, it will be a lot more straightforward to keep oneself from spending too much of money impulsively during the holiday seasons or family events.

Frequently Asked Questions

What is budgeting tips in simple terms?

Budgeting tips is a strategy or concept used to improve seasonal financial planning by focusing on structured, intentional methods.

How does budgeting tips help?

It helps improve performance by aligning your content with search behavior and industry best practices.

Can I apply budgeting tips myself?

Absolutely. With the right tools and structure, even beginners can begin applying these principles effectively.

What tools should I use?

Start with Google Search Console, SEMrush, and keyword research tools. These provide visibility into how budgeting tips impacts performance.

Next Steps

Want to take the stress out of seasonal finances? Grab your budget checklist and start building financial confidence today. Whether you’re gearing up for tax season or planning a summer getaway, a strong budget increases your peace of mind.

- Download Your Monthly Budget Template

- Quarterly Financial Review Checklist

- Budgeting 101 from Investopedia

- How To Make a Budget – Forbes Advisor

Grab your budget checklist and start shaping your future with intention—your wallet will thank you!